What Is Perpetual KYC (pKYC)?

The importance of robust Know Your Customer (KYC) processes cannot be overstated. Though traditional KYC practices were long considered the gold standard, they struggle to keep up with the dynamic, high-risk nature of today’s financial landscape. Enter Perpetual KYC (pKYC), an evolving framework that redefines compliance through continuous and real-time customer verification. In this article, we explore what perpetual KYC is, how it works, why it matters, and how to successfully implement it.

What Is Perpetual KYC?

Perpetual KYC is an automated, ongoing process that verifies and updates customer information in real time. Unlike periodic KYC methods, pKYC adopts a proactive approach, continuously monitoring and assessing customer data to ensure accuracy and alignment with ever-changing regulatory standards.

Why Is Perpetual KYC Important in AML Compliance?

Traditional KYC, which happens during onboarding and at predefined intervals, often leaves gaps where customer data becomes outdated. These lags increase vulnerability to financial crime, compliance breaches, and reputational damage.

Perpetual KYC eliminates these gaps by ensuring that customer profiles are consistently updated and assessed in real time. This helps financial institutions respond swiftly to risk triggers, meet AML obligations more effectively, and align with global regulatory expectations. In an age of accelerating cyber threats and stricter compliance frameworks, perpetual KYC is not just a best practice—it’s quickly becoming a necessity.

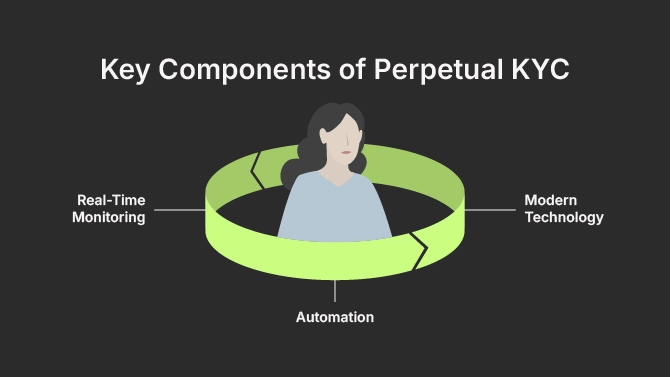

The perpetual KYC process functions through an interconnected system of real-time monitoring, advanced automation, and a robust technology stack. Together, these components enable financial institutions to conduct ongoing customer due diligence efficiently, accurately, and in compliance with evolving regulatory requirements.

By continuously updating customer data and assessing risk on an ongoing basis, pKYC empowers institutions to detect suspicious activity earlier, reduce the burden on compliance teams, and deliver a smoother experience for customers—all while mitigating financial crime risk and improving regulatory compliance.

Key Components of Perpetual KYC

Real-Time Monitoring

At the heart of perpetual KYC is real-time monitoring, which allows institutions to maintain constant oversight of customer data, transactions, and behavior. Rather than relying on static, point-in-time snapshots, this approach tracks activity as it happens, enabling proactive risk management.

When anomalies arise, such as unusual spending patterns, address changes, or alterations in beneficial ownership, they are flagged immediately. This facilitates faster investigations and early intervention, helping prevent anti-money laundering breaches or reputational harm before they escalate.

Real-time oversight also supports more dynamic customer risk profiles, adjusting scores and alerts as new information becomes available. This not only enhances accuracy but also ensures that risk decisions reflect the current reality rather than outdated records.

Automation

Automation is a cornerstone of modern pKYC processes, replacing time-intensive manual checks with smart workflows and rule-based triggers. It enables institutions to verify identity documents, validate data against third-party sources, perform sanctions screening, and assess financial crime risk—all with minimal human intervention.

Automated systems are capable of monitoring vast datasets continuously, identifying high-risk behavior, and initiating case reviews in real time. This reduces manual workload and allows compliance officers to focus on complex, high-priority tasks.

By automating ongoing monitoring, organizations achieve higher throughput, faster resolution times, and lower operational costs—all while meeting KYC compliance obligations more reliably. This level of efficiency also supports risk mitigation by ensuring that threats are detected and responded to without delay.

Modern Technology

The engine behind perpetual KYC is its technology stack, which combines artificial intelligence, machine learning, cloud computing, and API integrations. These technologies work in tandem to enable scalability, flexibility, and precision in managing ongoing customer due diligence.

- AI and machine learning models are used to detect patterns, predict risk, and adapt to new threats, reducing false positives and uncovering hidden indicators of fraud or money laundering.

- APIs allow seamless integration with government databases, PEP and sanctions lists, and real-time transaction feeds, ensuring the KYC ecosystem remains connected and up to date.

- Cloud infrastructure supports secure, global access to customer data while meeting data privacy and sovereignty requirements.

Collectively, this stack empowers institutions to evolve their compliance programs beyond static rule-checking into dynamic, intelligent systems that operate on an ongoing basis. The result is a more agile, responsive, and future-proof approach to regulatory compliance.

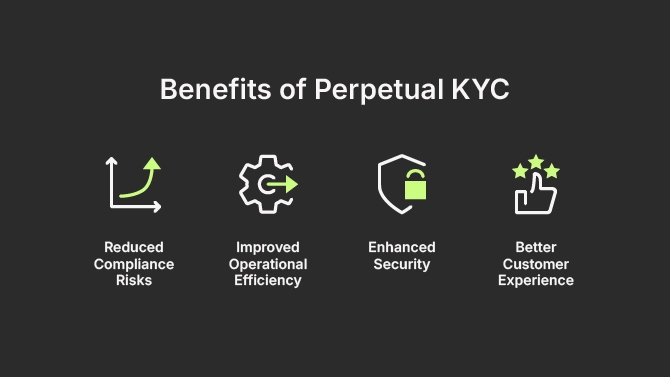

Benefits of Perpetual KYC

Implementing a perpetual KYC process introduces a forward-thinking approach to compliance, delivering benefits that extend beyond just satisfying regulatory requirements. By leveraging ongoing monitoring, automation, and real-time data updates, institutions can better manage financial crime risk while optimizing internal operations.

Reduced Compliance Risks

Continuous data monitoring enables financial institutions to stay ahead of emerging threats by proactively identifying changes in a customer’s risk profile. This dynamic oversight helps detect suspicious activities, changes in beneficial ownership, or risk-related triggers as they happen, rather than months or years later during a scheduled review.

The ability to respond in real time significantly reduces the chance of regulatory compliance breaches, enforcement actions, and reputational damage. As a result, pKYC enhances both preventative and responsive elements of risk management, offering a more resilient defense against Anti-Money Laundering (AML) violations.

Improved Operational Efficiency

Traditional KYC reviews often involve manual data collection, document requests, and periodic batch processes that consume significant time and resources. Automated pKYC processes, by contrast, streamline these tasks through intelligent workflows and seamless integrations with data providers.

This shift enables compliance teams to reallocate resources from routine verification tasks to higher-value activities like complex investigations and strategic oversight. Institutions adopting pKYC often report significant improvements in review cycle times, cost savings, and audit readiness, making KYC compliance more scalable and efficient.

Enhanced Security

pKYC solutions rely on a modern technology stack, including AI, machine learning, and robust encryption protocols. These technologies not only power the real-time verification process but also enhance the overall security posture of the institution.

With ongoing monitoring and automated alerts, potential threats to customer data—such as unauthorized access, anomalies, or inconsistencies—can be detected and resolved faster. This ensures that sensitive information remains protected at all times, reinforcing trust and reducing exposure to cyber risk.

Better Customer Experience

The perpetual nature of pKYC means customers are no longer burdened with repetitive document submissions or unexpected verification requests. Instead, data is collected and updated passively on an ongoing basis, resulting in fewer disruptions and a more seamless journey across digital channels.

By removing friction from the onboarding and account maintenance processes, institutions can deliver a superior user experience while still meeting stringent regulatory compliance standards. This balance between compliance and convenience is critical in today’s competitive financial ecosystem, where user expectations are high and tolerance for delays is low.

Perpetual vs. Traditional KYC

| Feature | Traditional KYC | Perpetual KYC |

| Check Frequency | Periodic | Ongoing |

| Process | Manual | Automated |

| Risk Approach | Reactive | Proactive |

| Information Accuracy | Often outdated | Always current |

Traditional KYC is typically performed at onboarding and reviewed every 1–5 years based on customer risk levels. Between these intervals, changes to customer data or risk status can go unnoticed, creating blind spots for fraud or compliance breaches.

Perpetual KYC addresses this by replacing static snapshots with continuous streams of data and dynamic risk assessments.

Challenges of Implementing Perpetual KYC

While the benefits are compelling, implementing pKYC is not without its hurdles:

- Legacy Systems: Many financial institutions still rely on siloed, outdated technology stacks that are incompatible with real-time workflows.

- Data Privacy Concerns: Continuous data collection must comply with GDPR and other data protection laws.

- Initial Costs: The upfront investment in automation and AI tools can be high.

- Internal Resistance: Shifting from manual processes to automated systems often meets organizational inertia.

Best Practices for Deploying Perpetual KYC

- Start With a Risk-Based Approach: Identify high-risk customer segments to prioritize pKYC implementation.

- Integrate with Existing Systems: Use APIs and modular solutions that layer onto your current infrastructure.

- Ensure Regulatory Alignment: Regularly update systems to reflect changes in AML regulations.

- Monitor Data Quality: The accuracy of pKYC is only as strong as the data it uses.

- Train Staff: Even the most advanced system needs human oversight and informed operators.

Real-World Example of pKYC in Action

A European fintech firm adopted a pKYC solution to replace its outdated manual review process. By integrating AI-driven transaction monitoring and dynamic risk scoring, the firm reduced its false positive alerts by 40%, shortened onboarding time by 60%, and improved regulatory reporting accuracy. The shift also freed up compliance officers to focus on more complex investigations, enhancing both efficiency and security.

Last Thoughts

Perpetual KYC marks a pivotal advancement in AML compliance, offering a modernized, proactive approach to customer due diligence. By integrating automation, AI, and real-time monitoring, it addresses the shortcomings of traditional KYC while boosting compliance, security, and customer satisfaction. As regulatory scrutiny tightens and digital ecosystems evolve, pKYC will be essential for institutions aiming to remain agile and resilient in the fight against financial crime.